does idaho tax pensions and social security

Exceptions include Canadian Social Security benefits OAS QPP and CPP and some railroad retirement. Idaho taxes are no small potatoes.

Idaho Affidavit Verifying Income Form Income Idaho Form

Additionally the states property and sales taxes are relatively low.

. February 20 2022 809 PM. 52 rows Employer funded pension plans exempt these self-funded plans may be fully or partly taxable. As a resident of Idaho all military retirement amounts included in your federal return are also taxable on your Idaho return.

Most pension benefits are currently taxable on your Idaho state income tax return. Part 1 Age Disability and Filing. New Mexico follows the federal rules for including a portion of Social Security benefits as part of taxable income but the state provides an 8000 tax credit to eligible.

States That Don T Tax Social Security. Overview of Idaho Retirement Tax Friendliness. However according to Idaho instructions Idaho allows for a.

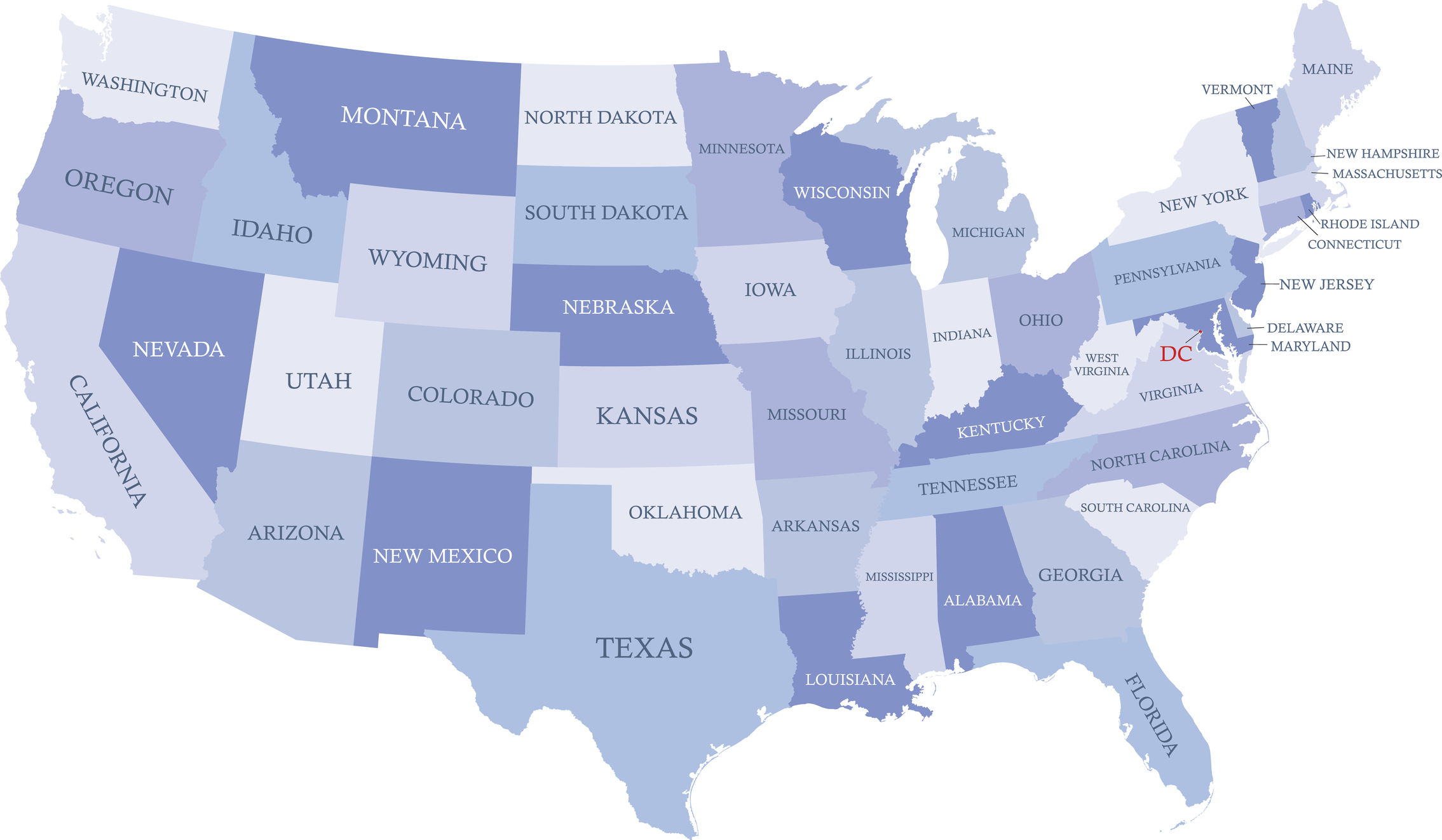

Most pension benefits are currently taxable on your Idaho state income tax return. For more information see the Hawaii State Tax Guide for Retirees. The federal government does tax up to 85 of social security benefits depending on your income but 38 states tax exempt social security income.

Social Security Benefits. New Mexico includes all Social Security benefits in the taxable income base though the state provides a deduction that reduces the taxability of all retirement income. The state taxes all income except Social Security and Railroad Retirement benefits and its top tax rate of 6 65 before 2022 kicks.

She became a resident of California and receives pension income from a job she had in Idaho. Does idaho tax pensions and social security Monday March 14 2022 Edit. Hawaii does not tax Social Security benefits.

The Idaho portion is zero since they dont tax social security. Idaho allows for a subtraction of retirement income on your state return if the taxpayer meets both parts of the two-part qualification that the state requires. Keep in mind this list doesnt necessarily.

37 States That Don T Tax Social Security Benefits The. If your income by that definition is at least 32000 if youre married filing jointly or 25000 for all other filing statuses up to 50 of your Social Security benefits could be taxed. 800-732-8866 or Illinois Tax Department Exclusion for qualifying retirement plans.

Even though the pension income is from an Idaho source federal law prevents. Social Security retirement benefits are not taxed at the state level in Idaho. I can do that enter zero for the Idaho Amount of my social security.

Do You Have To Pay Tax On Your Social Security Benefits Greenbush Financial Group

All The States That Don T Tax Social Security Gobankingrates

A Rundown Of Social Security Monthly Benefit Increases For Retired And Ssi Beneficiari Social Security Benefits Social Security Disability Social Security Card

Getting Social Security Disability For Rheumatoid Arthritis

Will Social Security Beneficiaries Get A Fourth Stimulus Check As Usa

Do You Have To Pay Tax On Your Social Security Benefits Greenbush Financial Group

.jpg)

Don T Want To Pay Taxes On Your Social Security Benetfit Here S Where You Should Move To

Social Security Disability Benefits Parkinson S Foundation

.jpg)

Don T Want To Pay Taxes On Your Social Security Benetfit Here S Where You Should Move To

/GettyImages-144560286-577404875f9b5858752b6d6d-1a80d8ccaca4477c86b8b840a36f8868.jpg)

Which States Don T Tax Social Security Benefits

Hobby Income For Retirement Youtube Retirement Planning Personal Finance Advice Retirement Pension

How To Calculate Your Social Security Taxes The Motley Fool

Are There Taxes On Social Security For Seniors Updated For 2022 Aginginplace Org

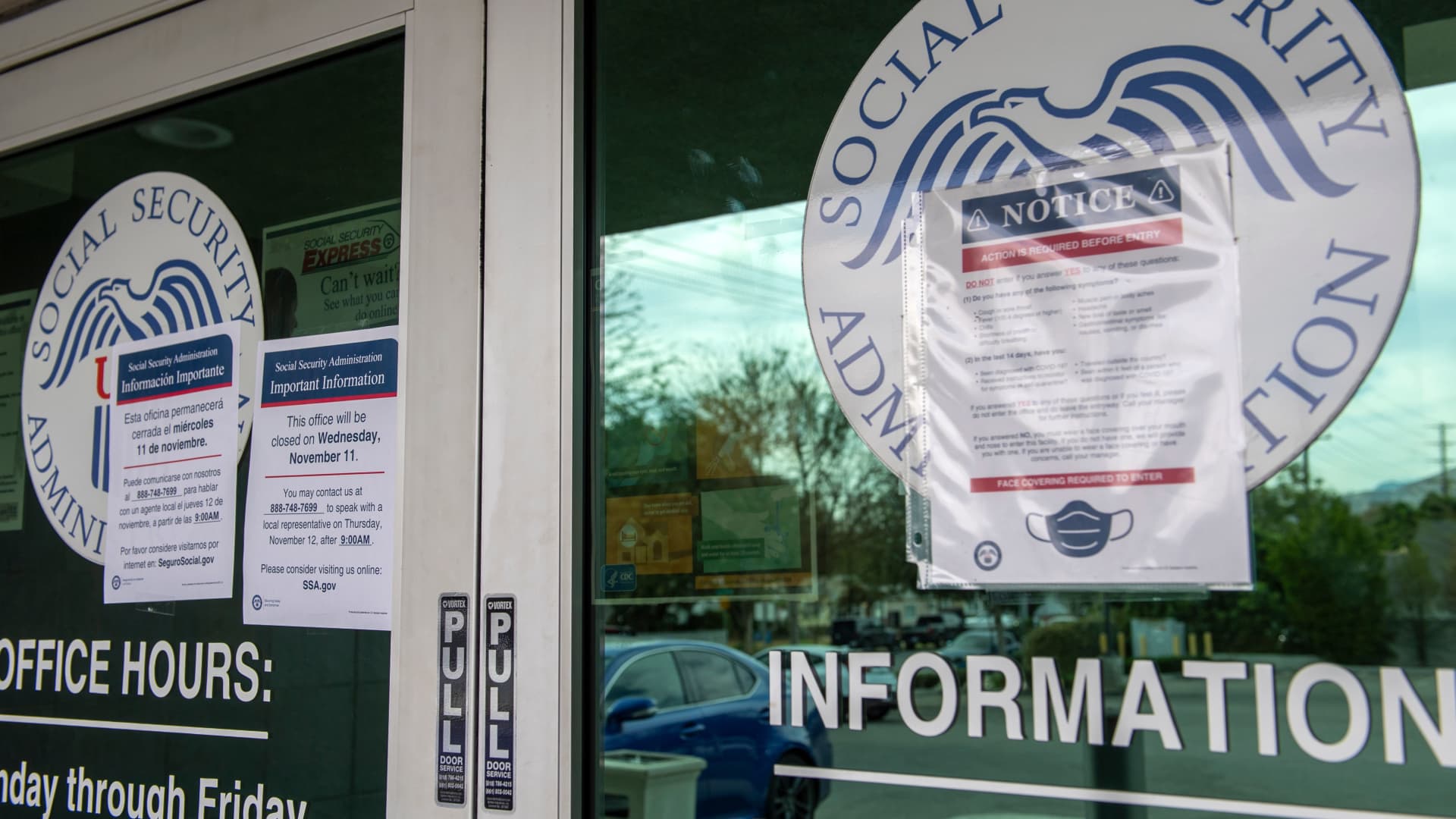

Watchdog Reports Reveal Problems At The Strained Underfunded Social Security Administration Pbs Newshour

13 States That Tax Social Security Income The Motley Fool

Social Security Trusts To Run Out Of Money Sooner Than Expected Due To Covid

15 States With The Lowest Social Security Benefit The Motley Fool

Do You Qualify For Social Security Disability Insurance Ssdi Benefits In New York Sobo Sobo

Idaho Is Quickly Becoming A Popular Retirement Destination Attracting Seniors From All Over The Country The Low Crime Rate And Idaho Places To Go Retirement